TOGETHER WE’LL STRIVE FURTHER AND AIM HIGHER

SCROLLOur Values

Whatever, Wherever, Whenever you need to have transportation of coal, iron ore, grains, Cement, clay, clinker, Bauxite, concentrates, dolomite, gypsum, limestone, manganese ore, mill scale, nut coke, pet coke, salt, sulfur, alumina, steel products, sugar, Ammonium, phosphate, BHF, DAP, MOP, rock phosphate...

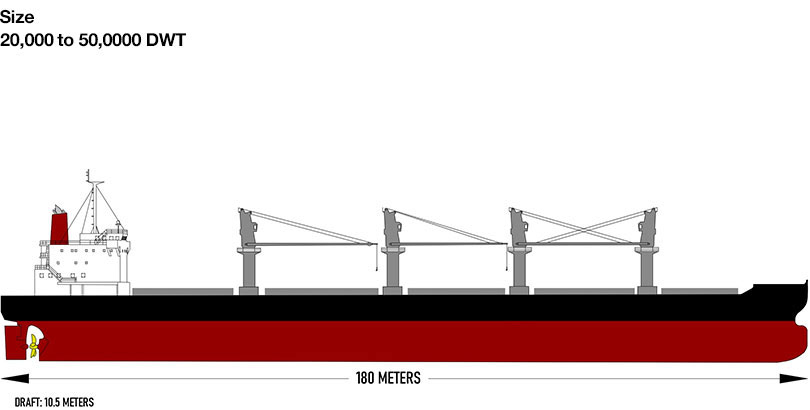

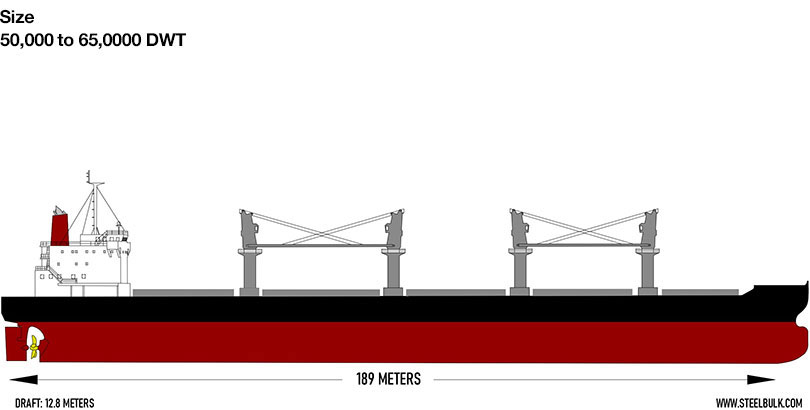

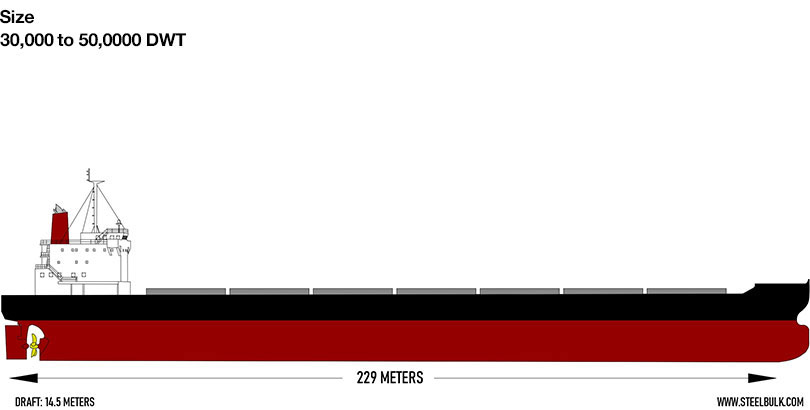

Our Fleets

We transport a wide range of dry commodities, including agricultural products, metals, construction materials, and others, around the world in a timely and safe manner. We understand.

GOODS CARRIED

- Cement

- Coal

- Fertilizer

- Grain

- Iron ore

- Minerals

- Scrap

- Steel

- Sugar

MAIN CLIENTS

- Cement manufacturers

- Fertilizer manufacturers

- Grain merchants

- Mining companies

- Power companies

- Steelworks

- Sugar producers

- Trading houses

GOODS CARRIED

- Cement

- Coal

- Fertilizer

- Grain

- Iron ore

- Minerals

- Scrap

- Steel

- Sugar

MAIN CLIENTS

- Cement manufacturers

- Fertilizer manufacturers

- Grain merchants

- Mining companies

- Power companies

- Steelworks

- Sugar producers

- Trading houses

GOODS CARRIED

- Cement

- Coal

- Fertilizer

- Grain

- Iron ore

- Minerals

- Scrap

- Steel

- Sugar

MAIN CLIENTS

- Cement manufacturers

- Fertilizer manufacturers

- Grain merchants

- Mining companies

- Power companies

- Steelworks

- Sugar producers

- Trading houses

Who we are

STEEL&BULK TRADERS SHIPPING PTE. LTD. (“Steel&Bulk Shipping Ltd” or “Steel&Bulk Singapore Pte Ltd” or “Steelbulk Denizcilik Limited Sirketi”) is an international Dry Bulk Chartering-Commercial Management of vessels company established in 2015 headquartered in Singapore and Istanbul. Steel&Bulk mainly operates in Panamax, Ultramax, Supramax, and handysize segments and provides...

MORE DETAILLocations

Turkey

İstanbul Office

Emaar Square Heights #15-1504

Uskudar – Istanbul

TURKEY

Singapore

Singapore Office

Singapore Land Tower

50 Raffles Place #37-00

SINGAPORE 048623

Select nation for contact informations

Please click the flags

Locations

Turkey

İstanbul Office

Emaar Square Heights #15-1504

Uskudar – Istanbul

TURKEY

Singapore

Singapore Office

Singapore Land Tower

50 Raffles Place #37-00

SINGAPORE 048623